All management teams want to position their company to weather the ups and downs of a business cycle without compromising its ability to thrive. The key to that goal is optimizing profit targets. While all organizations generally apply some effort to profit optimization initiatives, I’ve found that when those attempts fall short, it’s because they lack a strong framework for establishing the right targets or a strategy for executing on their goals.

Establishing this kind of framework is all the more important when economic trends are gloomy. A potential recession can cast doubt on expected revenue growth and cash flows. Inflationary pressures push wages, material costs, and operating expenses upward, eroding profitability unless they’re swiftly countered with price increases or other offsetting levers. Higher interest rates tighten the screws further, negatively impacting return on invested capital, especially for businesses with unhedged floating-rate debt obligations.

Living in the Future

Step 1: Define Optimal Profitability and Establish Targets

As Yogi Berra famously said, “You’ve got to be very careful if you don’t know where you are going because you might not get there.” Once you untangle this advice, it applies to all strategic planning. When dealing with profit optimization, it’s critical that management doesn’t engage in initiatives that deliver short-term improvements at the expense of long-term strategic objectives.

“You’ve got to be very careful if you don’t know where you are going because you might not get there.”

Frequently, I’ll see management teams set goals without knowing the true potential of their business. Traditionally, you’d analyze your historical data in order to estimate future profitability targets—however, that can shortchange your organization. In isolation, historical data can’t tell you everything about your business capabilities, especially as circumstances change, or whether your company’s previous performance is sustainable in the long term. If you only look at what you’ve done before, you could set a target that falls well short of—or worse, in excess of—what you can actually attain.

Step 2: Identify Levers to Optimize Profitability

Regarding the income statement, I like to take a top-down approach to identifying operating levers so that revenue is the first item under review. The guiding questions during this stage of the process should be:

- What revenue factors contribute most significantly to EBITDA margins?

- Which of these factors does management have the most control over?

- Which of these factors can help management differentiate the business and establish a competitive advantage?

Relevant Articles

Rest assured that we are always here to make your shopping fantasies come true!

Analytics

The US Food Delivery Market: Rapid Growth and Opportunities for Startups

The US food delivery market is experiencing unprecedented growth, opening up vast opportunities for innovative companies like Hive Group.

Finance

Personal Finance: Budget Management Tips in the Digital Age

In the age of digitalization, managing personal finances has become easier and more convenient thanks to a multitude of available tools and applications.

AI

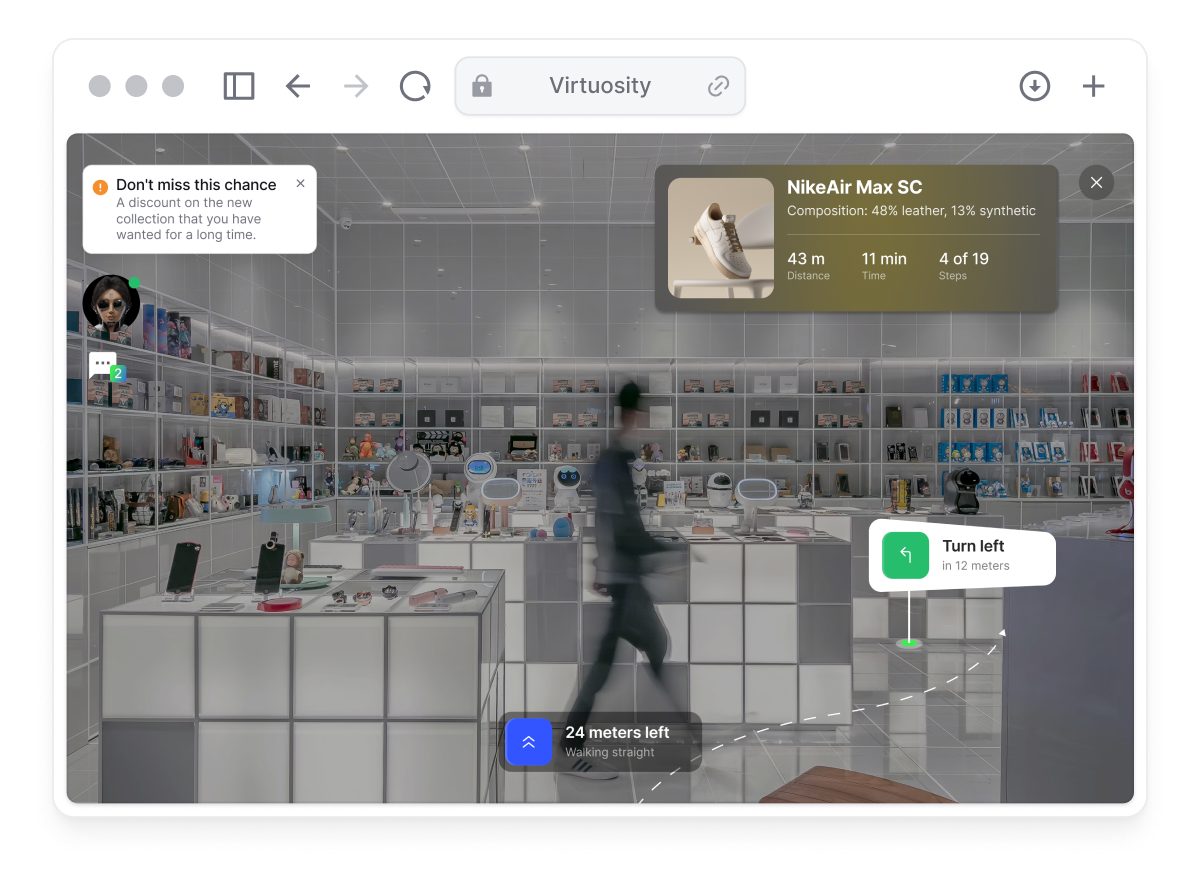

How Technology is Enhancing Customer Experience in E-commerce: The Use of AI and Augmented Reality for Personalization and Visualization

In the age of digitalization, customer experience is becoming a key factor for success in e-commerce.